The GEP Global Supply Chain Volatility Index indicates that global supply chains have reached a state of equilibrium, balancing capacity and demand effectively, with regional variations in performance.

Demand and Capacity Equilibrium

The latest GEP Global Supply Chain Volatility Index has revealed a slight increase to -0.18 in April, up from -0.32 in March, suggesting that global supply chains are operating near their full potential. This ‘Goldilocks zone’ indicates a balance where supply chains are neither overextended nor underutilized.

Regional Dynamics in Focus

Asia is leading the charge in this balanced state, with robust input demand noted in manufacturing sectors across South Korea, Vietnam, India, and China. Procurement activities in these countries have seen a consistent uptick, contributing to the overall health of global supply chains.

In contrast, North America is experiencing tighter conditions, with backlogs in manufacturing work, particularly in Mexico. Although demand for materials has seen a modest rise, it remains subdued compared to other regions.

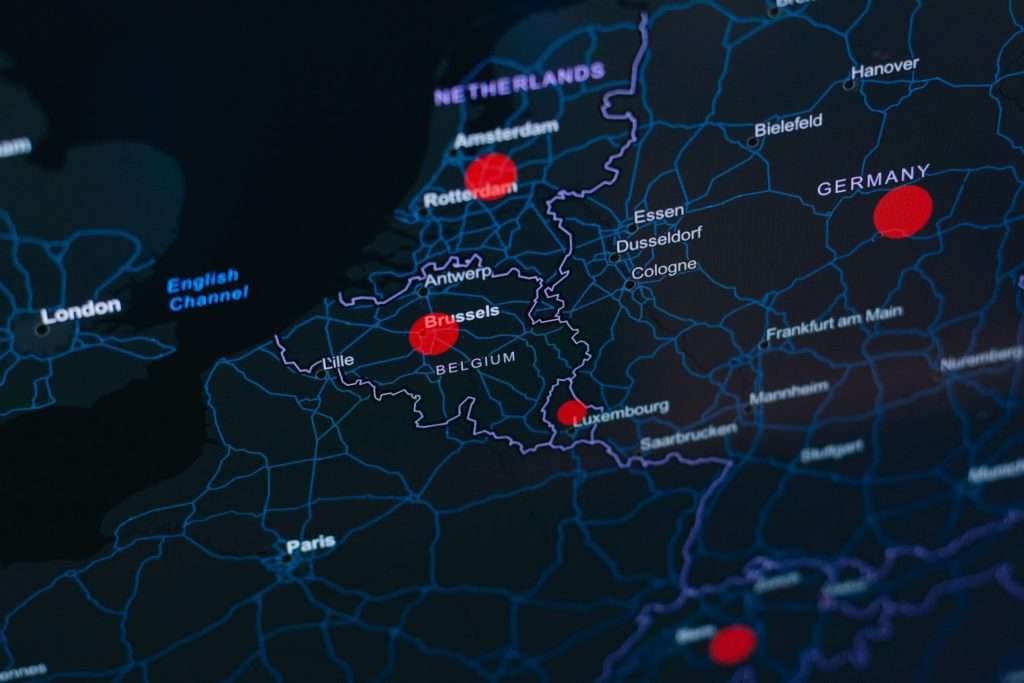

Europe’s manufacturing sector continues to struggle relative to its global counterparts, but the industrial recession that plagued the continent has shown signs of easing since the previous year.

Insights from Industry Experts

Mike Seitz, vice president at GEP Consulting, comments on the current state of global supply chains, noting the steady operations and the potential impact of Chinese manufacturing growth on international trade relations, especially considering the evolving U.S. trade policies.

Key Findings for April 2024

- Demand: The global demand for materials is aligning with long-term averages, with Asia contributing significantly to this stability.

- Inventories: Inventory levels are stabilizing, with fewer reports of stockpiling due to price or supply concerns, marking the lowest levels in over four years.

- Material Shortages: Instances of shortages in semiconductors, food, chemicals, and metals remain at historically low levels.

- Labor Shortages: While labor shortages have been a concern, the situation improved in April, aligning with historical norms, though regional disparities, particularly in North America, persist.

- Transportation Costs: A recent uptick in oil prices has led to increased transportation costs, the first such rise this year.

Regional Volatility

- North America: The index remains relatively stable, indicating some spare capacity with a slight increase in input demand and backlogged work.

- Europe: The index’s rise suggests a gradual recovery from the industrial downturn.

- United Kingdom: A significant decrease in the index as manufacturers choose to destock rather than order from suppliers.

- Asia: The index’s increase marks the first instance of stretched supplier capacity since January, reflecting the region’s strong manufacturing demand.

The current state of global supply chains suggests that achieving an optimal balance between capacity and demand is crucial for sustained operations across regions. As the dynamics of global trade continue to evolve, it is essential for organizations to adapt to these changing market conditions to ensure continued success.